Week ended Sept 13, 2024: it was an "everything up" week

- tim@emorningcoffee.com

- Sep 14, 2024

- 6 min read

SUMMARY

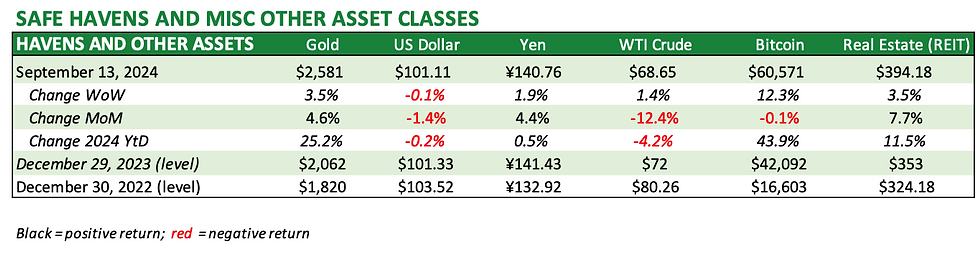

Last week was a “nearly everything rallied” week, although it wasn’t a straight trajectory up. Stocks were unusually volatile mid-week following the release of slightly worse-than-expected core CPI in the US, but it did not stop the S&P 500 from closing higher every single day, culminating in a WoW gain of 4.0% for the benchmark US index. This was quite a turnaround from the week before when the S&P 500 slid 4.2%. US stocks weren’t the only feel-good story though, as most global equity markets – aside from China of course – were in the green. The party for US fixed income investors also carried on last week, as US Treasury yields were lower across the curve, pushing total return bond indices higher. With fixed income now consistently registering gains, the old 60/40 or 70/30 stock/bond mix is delivering some very nice risk-adjusted returns this year, shaking off the drag of the last two years of negative returns for bonds. Duration looks like a damn fine place to be at the moment. In non-traditional asset classes, gold is certainly catching investors’ attention, with the price of the mother-of-all precious metals now up a whopping 25.2% YtD. I am never quite sure what the drivers of gold prices are, but it is clearly something technical because it cannot not be its safe haven status, certainly not at the moment when we are clearly risk-on. Is this “everything better” going to last? Probably not, but it’s been a nice bounce. I’m certainly not complaining!

Following last week’s ECB monetary policy decision, investors will be focused this week on monetary policy decisions by the Fed, the Bank of England and the Bank of Japan. My expectations are that the Fed lowers the Fed Funds rate by 25bps, the Bank of England does not alter the Bank Rate, and the Bank of Japan sits tight, too, more out of fear than necessity given what happened the last time the BoJ slightly tweaked its monetary policy tighter. Also, keep in mind that this is an FOMC meeting in which the Fed will release its revised set of economic projections, which could portend a lot about future monetary policy.

WHAT HAPPENED LAST WEEK THAT MATTERED

US CPI August

US core CPI for August (MoM) came in slightly higher than expected, rattling risk markets for a couple of days mid-week as investors digested the increased likelihood that the Fed would take a measured approach and reduce its benchmark policy rate by only 25bps (rather than 50bps) at this week’s FOMC meeting. However, something I cannot identify changed the tone of markets in the second half of the week. The CME FedWatch Tool is now even odds between a 25bps reduction or a jumbo cut of 50bps on Wednesday. The FedWatch Tool is also now predicting 125bps in total reductions in the Fed Funds rate by the end of the year, up from 100bps last week at this time.

ECB reduces policy rates

The ECB reduced its benchmark policy rates 25bps as anticipated, with most analysts focused more on the “body language” from President Lagarde around subsequent reductions. In the post-release statement and Q&A, Ms Lagarde highlighted the weaker-than-expected 2Q2024 growth in Europe, a resilient job market, and decreasing inflation as reasons for the policy rate reductions. She was coyer about future reductions, although pundits felt that she and her governing officials were most likely suggesting no change at the next meeting, with another 25bps reduction likely at the final meeting of the year in December. In her comments, she also highlighted her agreement with the report released at the beginning of the week by former ECB president Mario Draghi about European economic stagnation (more below).

Mario Draghi’s “The future of European competitiveness”

Mario Draghi, under sponsorship from the European Commission, released an insightful report focused on what Europe needs to do to close its productivity gaps with the US and China. You can find the two-part report entitled “The future of European competitiveness” here (Part A) and here (Part B). It’s long and I did not read it all, but caught plenty of summary extracts in the financial press, and also skimmed the documents. If you don’t care to read all of the 400 page report, I suggest you at least read the five-page “Forward” section by Mr Draghi in Part A, which provides a good and concise overview of the issues he has identified as stunting European growth, the challenges the economic bloc faces, and what can be done to address these headwinds going forward. Not surprisingly, Mr Draghi is focused on the need for fiscal harmonisation in the European Union, an objective that – at least to me – seems out of synch with the current political leanings favouring more nationalistic (as opposed to common EU) policies. Reform is necessary based on what are relatively common and agreed challenges ahead, but getting the disparate views of the member-states aligned to act in the interests of the broader EU seems nearly impossible. As mentioned above, Ms Lagarde pointed towards this study following the ECB montary policy decision, highlighting the importance of more fiscally coordinated firepower in Europe to address slow growth. Interestingly, the fabric of the report will be immediately tested, as the next day Unicredit announced that it had built a 9% stake in German bank Commerzbank, highlighting perhaps the poorest example of cooperation in Europe across countries – cross-border bank consolidation.

The US Presidential debate

The US Presidential debate came and went, with US voters interpretation of who won the debate largely falling in line with the candidate they support. For a non-aligned voter, it seemed fairly obvious which candidate took the high road and which took the low, certainly in line with each candidate team’s rhetoric before and since the debate. At times, the debate was painful to listen to, but a good slice of America eats the various conspiracy theories up like a baby eating candy. Nothing has really changed – it all boils down to swaying uncommitted independent voters in several swing states. The financial markets saw the debate the same – markets didn’t really react positively or negatively following the debate, although the fact is risk ramped up after the debate, perhaps reflecting relief that the spectacle was over.

MARKETS LAST WEEK

As mentioned in the opening commentary, you would be hard-pressed to find a risk market aside from Chinese stocks (ugh, that’s getting so old!) that didn’t rally last week. For US equities, it’s a telling sign about volatility and how quickly investor sentiment can shift, when we string together the worst week in a long time (week before last), followed by the best week in a long time. Go figure. Every time retail investors head for their caves and the bears peek out, they get crushed. I expect even more volatility in the run-up to the US presidential election, although the various probability-weighted outcomes are probably baked into levels now. The bond market continued to improve with the 2y-10y curve hanging up to its upward slope (albeit barely). One might argue that the fate of the UST market next week depends on the pending FOMC decision. After skidding near recent lows, even oil managed to hold its own this week. Gold has been the surprise performer this year, now up an amazing 25.2% YtD. Gold spent most of the week well above $2,500/oz and ended the week knocking on the door of $2,600/oz. Credit markets were firm, with spreads stabilising as equities firmed. Tables are below.

WHAT’S AHEAD

Investors will be focused this coming week on monetary policy decisions by the Fed, the Bank of England and the Bank of Japan. However, there is also some important economic data that will be released.

Economic data this coming week includes

o US: retail sales for August, housing data for August, first time jobless claims

o UK: inflation data for August (CPI, PPI); retail sales for August; consumer confidence

o Eurozone: 2nd read August inflation data; consumer confidence

o Japan: import/export data, and inflation (CPI) for August

Monetary policy meetings:

o FOMC: Sept 17/18, Nov 6/7 and Dec 17/18

o Bank of Japan: Sept 19/20, Oct 30/31 and Dec 18/19

o Bank of England: Sept 19, Nov 7 and Dec 19

o ECB: Oct 17 and Dec 12

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments