Week ended June 14, 2024: US inflation slows

- tim@emorningcoffee.com

- Jun 15, 2024

- 3 min read

SUMMARY

Stocks were mixed on the week, with European indices in particular under pressure following the surprising advances of the right in the European Parliamentary elections last Sunday.

In the US, both the S&P 500 and NASDAQ indices touched record highs intraweek (again), with the DJIA and the Russell 2000 losing ground.

Yields fell as bonds rallied on better-than-expected inflation data in the US, boosting investors’ hopes that the Federal Reserve might be more aggressive in its monetary policy easing.

The FOMC released its latest monetary policy decision midweek, including a revised Summary of Economic Projections. Counter to investors’ expectations, the Fed is projecting only one interest rate reduction in 2024.

The Bank of Japan left its monetary policy intact, although the central bank said it would examine the on-going purchases of government bonds between now and its next monetary policy meeting in late July.

I wrote mid-week about Apple’s (AAPL) stock price surge and the on-going GameStop (GME) saga, which you can find here if you missed it.

WHAT MATTERED LAST WEEK

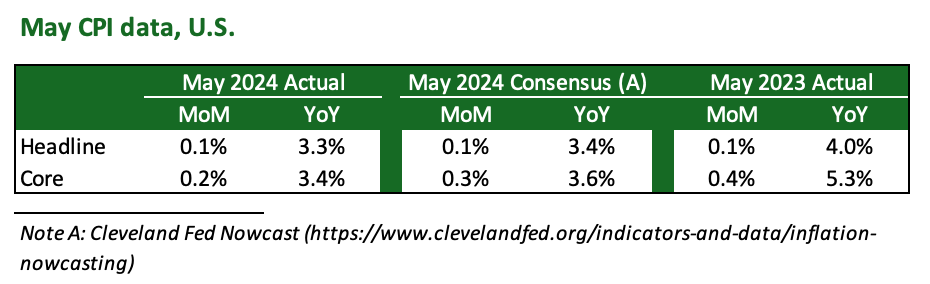

US CPI, released on Wednesday before the US open (left two columns), was slightly better than expected (middle two columns), pushing stocks higher and bonds yields sharply lower.

Food and shelter rose the most, but were offset by declines in energy costs, including gasoline. Investors believe that there will now be two reductions in the Fed Funds rate this year because of signs that the jobs market is ever-so-slightly weakening (see Thurday’s first time payment claims for example), and inflation is slowing. The CME FedWatch Tool is suggesting two reductions this year – one in September and one in December. You can find details of the May CPI report in the BLS CPI Summary.

The FOMC left monetary policy unchanged, as expected (FOMC Statement here). Perhaps more importantly, the Fed released its revised Summary of Economic Projections indicating that the FOMC only expects to reduce the Fed Funds rate once this year. This aligned with Mr Powell’s post-FOMC press conference comments, too, which had a slightly hawkish tilt and is not in line with investors’ expectations.

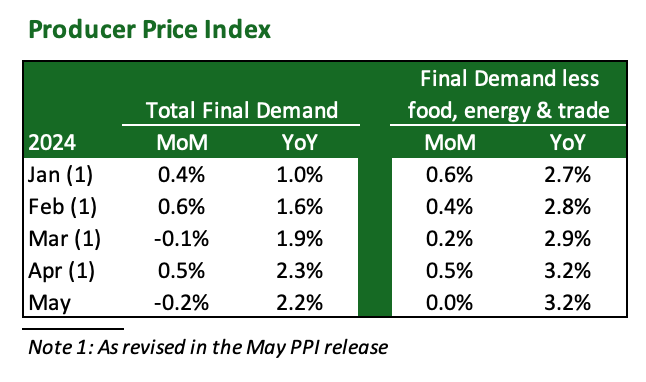

Following better-than-expected CPI, May PPI for the US – released Thursday before the open – also came in better-than-expected.

Digging slightly deeper, May’s PPI decline in “total final demand” was driven principally by lower energy prices (-4.8%). Final goods PPI declined 0.8% in May, while services PPI was flat.

MARKETS LAST WEEK

I am continuing a a new format for the tables, which hopefully are less cluttered and more helpful to my readers. Feedback would be welcome from readers.

Global equity markets were mixed last week, with Europe suffering the most following the surprise advances of the right in European Parliamentary elections last Sunday.

In the US, both the S&P 500 and the NASDAQ reached record highs intraweek, driven by the ongoing surge in big tech shares and expectations of more aggressive Fed easing. However, both the Russell 2000 and the DJIA lost ground.

US Treasury bond yields were lower across the curve last week, continuing the prior week’s trend. The catalyst was the better-than-expected May CPI report, released Wednesday before the open.

Although yields remain elevated vis-à-vis year-end 2023, the recent declines have pushed long-duration USTs to a modest gain on a total return basis YtD.

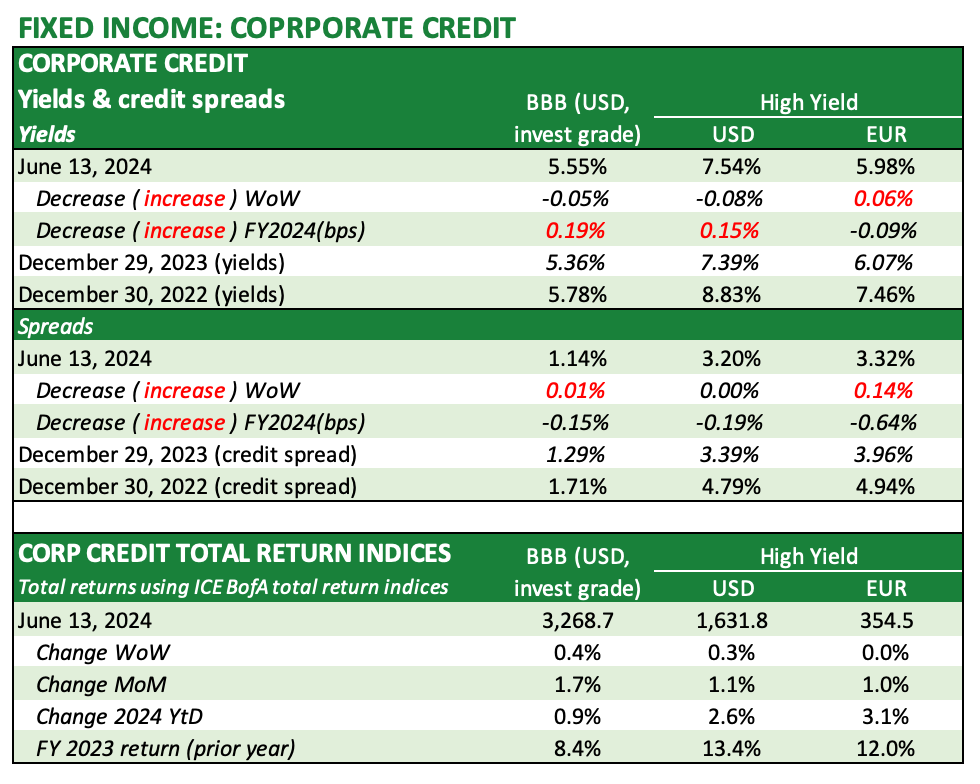

Corporate bond spreads were steady in the US, but pushed wider in Europe as political risk increased.

Gold, the US Dollar and oil prices were all higher on the week. The Yen lost ground following the BoJ monetary policy decision (to leave rates intact), and the Euro was sharply lower vis-à-vis the US Dollar following heightened geopolitical risk in the Eurozone, driven by political uncertainty in key member France.

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments