The world is fraught with geopolitical risk, but the areas of focus which have caused concern for much of 2024 have suddenly been pushed into the background, superseded by risks that weren’t imaginable a week or two ago. With the French government in disarray, South Korean President Yoon Suk Yeol declaring a brief period of martial law earlier in the week, rebels (re)taking Aleppo (and more) in Syria, a judicial annulment of the recent Romanian election due to Russian interference, and Georgia’s citizens taking to the streets to protest against the new fragile government’s decision to halt EU accession talks, a new slate of geopolitical issues has moved to the forefront. Suddenly, the recent U.S. Presidential election looks like a walk-in-the-park when viewed in the rearview mirror, in spite of the tension and rhetoric that was present in the U.S. for months during the run-up. I suppose there is good news in that tensions in the Middle East have slightly subsided with Israel and Hezbollah having struck a cease-fire deal, although the Israel’s conflict to the south with Hamas remains an open sore. And it’s hard to say what might come next in Ukraine although it is increasingly looking as if an end to the war would benefit both Ukraine and Russia.

Investors seem oblivious to these risks, at least given the direction of travel of risk assets over the last five weeks. With U.S. equities, Bitcoin and other risk assets reaching record highs day after day, one can’t help but wonder “is there any end in sight?” Investors are increasingly leaning into many of the proposed pro-business policies of the incoming Trump administration, although I have doubts as to whether the right wing of the Republican Party in Congress (certainly in the House) will be fully supportive of Mr Trump’s inflationary and deficit-increasing fiscal policies. Perhaps the solution to all of this will involve the efforts of DOGE. The focus on reducing government fat has support of Republicans, as well as a growing array of centrist Democrats (not to mention most investors, including this one). However, the magnitude and speed of projected cuts, should they even materialise, is impossible to forecast. The idea of both lower taxes and drastic cuts in expenditures to reverse the growing deficit is a compelling idea, but I think it will be much more difficult in practice. Time will tell.

US jobs / other economic data

US economic data – including Friday’s job report (here) – continues to suggest that the U.S. economy is gliding gently towards a so-called “soft landing”. More jobs were added in November than expected, although the unemployment rate ticked up slightly to 4.2%. The data certainly added support to the likelihood of a reduction in the Fed Funds rate at the next FOMC meeting, with the probability increasing from 65% before the jobs data was released on Friday morning to 86% afterwards (CME FedWatch Tool).

From a political perspective, the U.S. government remains in a lame duck period, with Mr Biden effectively neutered and Mr Trump not yet officially in office. In essence, this is a perfect period for investors since economic momentum in the U.S. should continue unabated until at least Mr Trump’s inauguration on January 20th, a couple of weeks after the new members of Congress are sworn in (on January 3rd). Until then, there is little tangible risk associated with a widening deficit, the stubborn “last mile” of inflation, or the imposition of tariffs. Piling into risk assets reflects this, as the VIX (measure of stock market volatility) has settled back below 13, and US stocks are heading “to the moon.”

Bitcoin soars to new record high

Although not a “crypto bro”, I would be remiss not to mention that the cryptocurrency market is eating up the fact that Mr Trump is bringing his crypto-friendly agenda into office. This past week, Mr Trump nominated crypto-supporter Paul Atkins as head of the SEC, pouring more fuel on the proverbial fire. This took Bitcoin to above $100,000 for the first time, a milestone that advocates have been championing for some time, but which looked much further off prior to Mr Trump’s election victory in early November. I can’t help but feeling severe FOMO, watching any and everything crypto gap higher and higher.

OPEC+ / oil prices

Oil prices were stable much of last week in spite of uncertainty about the next move by OPEC+. Even when OPEC+ announced late in the week that they would extend their production cuts into 2025, oil prices barely budged. From a longer term perspective, the price of WTI crude is lower by 6.2% YtD, but it is more than 20% below its mid-April highs. I will direct my readers to an article I wrote in June 2023, and I stand by my statement in that article:

“……..I think that in most cases, OPEC+’s supply manipulation has a sharp short-term effect but is rather quickly rendered impotent.”

Analysts last week pointed out several things that are increasingly making OPEC+ less relevant in the global marketplace.

Firstly, OPEC+ now accounts for 48% of global supply, a significant albeit decreasing percentage of the total market. The cartel’s influence remains important and at times market-moving, but OPEC+ far from being able to single-handedly influence prices, especially when the world’s largest large oil-consuming country – the U.S. – can now meet their demand domestically.

Secondly, the cartel does not seem to understand economics very well. Global oil supply is determined not only by demand, but also by the market price of oil compared to its lifting (i.e. extraction, refining and production) cost. The higher the price of oil in the global marketplace, the more petroleum companies extract oil at the margin, which otherwise might not be economical in a lower oil price environment. By holding prices artificially high in the global market, OPEC+ is effectively encouraging marginal production by non-OPEC+ members. The issue is very visible in the U.S., since a lot of oil – especially oil that is extracted from shale – has lifting costs of $60 or above according to TGS. With high global oil prices, U.S. producers find it economical to extract more and more oil.

Lastly, oil demand is correlated with economic growth. Strong global economic growth spurs demand for oil, while weaker growth reduces demand. Aside from growth in the US, other large economies around the world look slightly more fragile to say the least as we look forward. The IMF is projecting global economic growth to flatline in 2025 at 3.2%/annum, not bad although the world’s two largest economies –the U.S. and China – are expected to experience declining growth (2025 vs 2024).

Barring an unforeseen supply disruption due to a global flashpoint, I think oil prices (WTI) will remain in the $60-$70/bbl area no matter what OPEC+ does as far as trying to curtail supply.

Central bank meetings

This week, the ECB kicks off a series of the monetary policy meetings – the last ones of the year – for a group of important countries, including the Eurozone, the U.K., Japan and the U.S. The ECB is largely expected to reduce its policy rates a further 25bps at its Monetary Policy meeting this week, and to reduce its policy rates a further 100bps in 2025.

MARKETS LAST WEEK

Equities: Global equities powered forward last week, led by Asian and European stocks. US equities were mixed, with the S&P 500 and the NASDAQ registering gains, and the DJIA and Russell 2000 losing ground. Even with all the talk about a rotation from tech stocks into value stocks, tech stocks one again led the charge.

US Treasuries: US Treasuries improved marginally last week across the curve with yields declining 2bps-3bps. UST yields, which spiked the day after Mr Trump’s election victory, have now declined back to the levels of mid-October. Perhaps this reflects a more realistic picture of what the Republican-led Congress is likely to support as far as expansionary fiscal policies. Nonetheless, the “Trump bump” remains in place as far as risk assets, with the negative effect of Mr Trump’s election in the bond market largely disappearing.

Credit/corporate bonds: I’m starting to ask how stocks keep going up and credit spreads on risky bonds (i.e. high yield bonds) keep tightening. There’s no doubt that risk assets are priced across the board for perfection, and this includes high risk corporate bonds. Of course, it’s difficult not to jump on the momentum trade (or stay involved), and for investors not involved, it is painful as far as opportunity cost to have missed this run. My fear is that whatever brings the momentum to a halt will probably be something we just don’t see at the moment.

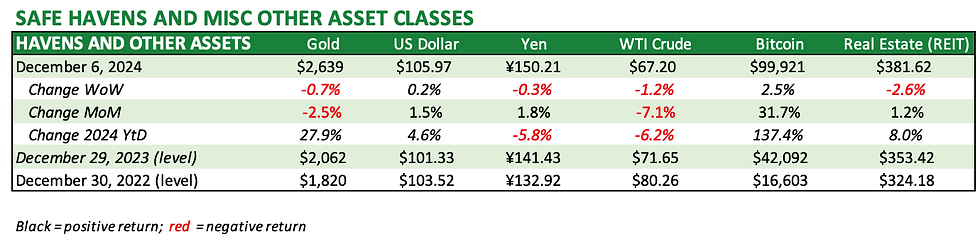

Other assets: Bitcoin passed $100,000 during the week, while the price of gold was slightly lower. The US Dollar remained firm.

MY TRADES LAST WEEK

Most of the covered call trades I wrote at the end of the week before last expired on Friday, with the exception of AAPL (242.5) which I rolled to next Friday at 250. I also wrote another series of covered calls one week forward on LULU (great earnings, stock gapped higher), MSFT, CRWD, NVDA, AMZN and AAPL.

WHAT’S AHEAD

Economic data: Various economic releases are slated for next week, with the most influential largely expected to be CPI for November for China (Mon), Germany (Tues) and the U.S. (Weds). Japan will announced 3Q24 GDP on Sunday, and the U.K will release October GDP on Friday, along with GfK consumer confidence.

Monetary policy meetings (and expectations):

ECB: Dec 12 (nearly all economists expecting 25bps reduction in Euro policy rates)

FOMC: Dec 17/18 (90%+ probability the Fed Funds rate is reduced 25bps)

Bank of Japan: Dec 18/19 (unclear / limited signals so far)

Bank of England: Dec 19 (90%+ probability of no change in the base Bank Rate)

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****xxx

Comments