It was another uninspiring week as far as debt and equity markets, as least in terms of excitement, although the slow drift lower continues for US equities and debt. Before getting into the depressing topic of markets specifically, it is fair to say that the global talking points of the week were mainly around China’s economy – which is looking increasingly fragile – and UST yields, which keep heading higher. To spice up your weekend (I really hope that’s an overstatement!), let me touch on both.

China

China continues to be haunted by the same recurring problems that have been lurking around for many months now, although it is clear now that the concerns are broadening and deepening. It started with a few cracks in the over-heated property sector a couple of years ago. The deterioration in this important growth engine for China continues to be a drag on economic growth. Moreover, it now seems to be splattering the Chinese consumer, as consumers rein in spending and prices stagnate. So far, the government has not provided enough of a response to quell investors’ concerns, which are growing by the day.

Country Garden is under the microscope as I write this, with the shares getting battered this past week in Hong Kong as investors fear the worst. The chart below shows the trajectory of Country Garden’s share price on the Hong Kong Exchange over the last five years, and it’s not a pretty picture.

Also, China Evergrande – which defaulted on its debt in 2021 – filed for bankruptcy in New York this past week. And to make matters worse, it was reported this past week that Chinese shadow lender and wealth manager Zhongzhi Enterprise Group stopped making payments on some of its products and has retained KPMG to assist with a potential restructuring.

These can be viewed as related events in many respects, as the property sector remains under stress in China, and this undoubtedly means that Chinese banks (and shadow banks) must be feeling the pain, too. It appears that domestic consumer demand is also fading quickly according to the China Beige Book’s July survey. You can watch an official from the China Beige Book speaking about its latest data here (four minutes). The fixed exchange rates for the Renminbi are slowly being relaxed by the government as the currency feels the pressure. The confluence of data is reinforcing a wicked downward spiral that needs to be quickly snuffed out by the government or it could worsen quickly to a point of no return. Even so, China’s economy is still expected to grow around 5% this year, one of the fastest growing economies in the world, and certainly much better growth than G7 countries. As the second largest economy in the world, it is almost certain that a faltering Chinese economy will have knock-on effects into the global economy, including US growth.

As an investor in China (via an ETF), I understand the risks of investing in China or any other emerging country. Although I don’t normally invest in emerging markets stocks or bonds, I felt China was an exception because of its importance on the world stage as the world’s second largest economy, and one of its fastest growing. I am not sure what the government will do next. Equally concerning is that certain Chinese government agencies are embarking now in “selective disclosure”. For example, the National Bureau of Statistics in China recently announced that it will no longer release youth unemployment, which has been increasing rapidly. This decision undermines the integrity of all economic data coming from China, and this tends to make investors – or at least this one – increasingly uneasy.

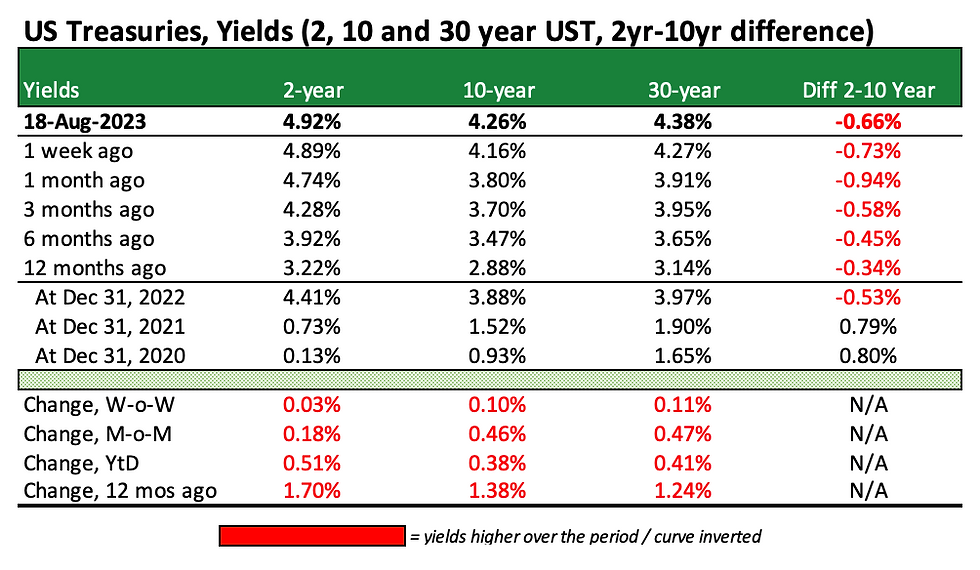

Bond yields

Last week I alluded to two factors that are putting pressure on yields at the intermediate and long end of the US Treasury curve:

Pent-up funding needs of the US Treasury, following a period when the Treasury was issuing less debt as the debt ceiling discussions dragged on (see further discussion below), and

The Federal Reserve’s quantitative tightening programme, which involves the effective run-off of $95 bln in USTs ($60 bln) and MBS ($35 bln) each month.

There is one other driver that might be affecting yields, and this involves less demand for USTs from Japan and from China, the two largest foreign holders of USTs. For context, there is $25.1 trillion of UST outstanding held by non-US government investors (SIFMA), of which approximately $7.4 trillion was held abroad as of April 2023 according to Statista. Of this amount, Japan ($1.13 trillion) and China ($869 billion) were the largest two foreign holders of USTs. China was slowly reducing its holdings of USTs well before it started experiencing economic difficulties, and I would think this current rough patch economically might cause them to accelerate their sales. Japan is experiencing higher domestic yields, and this might be steering domestic investors into Japanese bonds at the expense of USTs, although I haven’t researched this enough to say anything more definitive. (See S&P Global article here for more.) Nonetheless, these two large foreign holders of USTs are reducing their holdings of USTs, and this removes a meaningful component of demand from the market.

As far as issuance by the US Treasury, SIFMA data shows that YtD issuance of UST bills, notes and bonds is running about $2.25 trillion ahead of the level of issuance for the same period of 2022, a sharp increase in the funding amount. New issuance was less in 2Q2023 than anticipated (due to debt ceiling discussions). Perhaps not surprisingly the Treasury announced on July 31st that it was increasing its borrowings in the 3Q23 to $1.007 trillion, $274 billion more than was expected for the third quarter just three months ago (recent press release from US Treasury here).

Of course, I continue to be concerned about inflation although the data seems to be trending in the right direction. In the meantime, these supply-demand factors will play an influential role as far as keeping pressure on yields of intermediate and long-dated UST bonds. My assessment is that there is currently asymmetrical downside risk for USTs, but I suspect the combination of a slowdown in the US economy later this year and gradual disinflation will cause yields to end the year lower than they are currently, even if they go slightly higher from here in the coming few weeks.

WHAT'S AHEAD?

The Jackson Hole Economic Symposium entitled “Structural Shifts in the Global Economy” runs from August 24-26. I have not seen an agenda. The website is here.

Interest starts accruing again on US student loan debt on September 1st, with payments resuming in October 2023. You can find further information on the Federal Student Aid website. Student loan debt in the US is around $1.6 trillion.

Nvidia (NVDA) announces earnings on August 23rd, and there will be plenty of focus on the last of the seven tech giants to release this cycle. Stats for reference are:

· forward P/E of 55.25x,

· price-to-sales of 41.8x,

· enterprise value of 165.6x trailing EBITDA, and

· stock has tripled in value since the end of 2022!

There is downside price risk at these nosebleed valuation levels as Nvidia will need to beat consensus expectations and provide glowing guidance to support anywhere near the current share price, or so it seems to this old-timer!

Upcoming central bank meetings are as follows:

· Federal Reserve (FOMC): Sept 19-20 (with updated projections)

· ECB: Sept 14

· Bank of England: Sept 21

· Bank of Japan: Sept 21-22

THE TABLES

The tables below provide detail across various global and US equity indices, the US Treasury market, corporate bonds and various other asset classes for the week and other periods.

Global equities

US equities

US Treasuries

Corporate bonds (credit)

Safe haven and other assets

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

One look at the yield curve tells everyone that the outlook on rates is uncertain. The Fed tells the market they're not certain whether they will raise rates further and are taking a pause or maybe they will just hold rates at these levels longer or whatevs. We have it from the horse's mouth.

While US inflation has stopped rising, where rates may come to rest is a tough call. The vigilantes are telling us its at least 6 months too early to make that call and these street-wise makers of the yield curve tell us after that, valuations are hard to call. My guess its more like a year before we know but it ain't going to be at…