Week ended Aug 16, 2024: "everything up" week!

- tim@emorningcoffee.com

- Aug 17, 2024

- 4 min read

SUMMARY

It’s August so volumes are down although risk markets are clearly back in business. In fact, it was nearly an “everything up” week. Bonds didn’t do badly either, as yields at the intermediate and long end of the curve declined slightly during the week.

US economic data – including PPI and CPI last week – were largely in line with expectations, suggesting that inflation is continuing to moderate. Other economic data suggested that simultaneously, the US economy continues to head towards a potential soft landing, with first time jobless claims (Thursday) and US retail sales for July better than expected. The narrative from three weeks ago including “an imminent recession”, “emergency Fed rate cut”, VIX > 60, etc., feels like ancient history now!

Japanese equities are clawing back their losses as the Yen slowly (re)weakens. Japanese 2Q24GDP growth was positive (+0.8% QoQ / +3.1% YoY), following three lacklustre quarters including a decline of -0.6% QoQ in 1Q24. Inflation remains slightly elevated by Japanese standards. This economic profile could leave the BoJ in a quandary as to what to do next, since a (re)weakening Yen will encourage carry trades to be put back on.

UK 2Q24 GDP growth was +0.6% MoM / +0.9% YoY, in line with expectations and just below 1Q24 GDP of +0.7% MoM. This makes the UK the fastest growing economy in 1H2024, although don’t get used to it!

Inflation figures for July in the UK were also encouraging, with headline and core CPI coming in at 2.2% YoY and 3.3% YoY, headline slightly higher YoY but in line with expectations, and core CPI slightly lower. Month-over-month (vs June), inflation was flat to slightly lower. Services inflation – a particular concern of the BoE (and most G7 central banks) – also cooled. This “near perfect” economic data opens the door for further reductions in the policy rate by the BoE at upcoming Monetary Policy meetings.

Eurozone 2Q2024 GDP growth was +0.3% QoQ / +0.6% YoY, slightly better than expected but with a caveat that the major drag on economic growth in the common currency bloc continues to be its largest member, Germany. CPI data for the EU and Eurozone will be released this coming Tuesday.

China is continuing to experience lacklustre growth (by its historical standards), with data showing a mix of better-than-expected growth in consumer spending offsetting ongoing declines in industrial growth. Of course, the real estate overhang is yet to be sorted.

The US presidential race is a race to the bottom, at least economically, with both candidates proposing various tax reductions and expenditure increases that – at this point – are unfunded. It is amazing how few voters understand the ramifications of these populist proposals on the US economy and the national debt. One candidate also wants to stick his fingers into the independent Fed, very bothersome at least for me. Financial markets seem to have adjusted to either outcome it seems, recognising that most of these proposals are nothing more than political gibberish designed to woo undecided / centrist voters. This election can’t end soon enough!

MARKETS LAST WEEK

Global equities were better across the board, with Japanese equities leading the charge as Japanese stocks continue to claw back recent losses. US equities were also better across the board, with perhaps – not surprisingly – the recovery of tech shares leading the NASDAQ to the best gains among the indices that EMC tracks.

US Treasury bonds were less volatile than the week before, as yields at the intermediate and long end of the curve declined, generating positive returns for total return indices. Yields at the more policy-sensitive short-end of the curve were mostly unchanged, as investors have migrated back towards a 25bps reduction (from a jumbo 50bps reduction) at the September FOMC meeting, followed by two further 25bps reductions in the Fed Funds rate at the November and December FOMC meetings (source is CME FedWatch Tool).

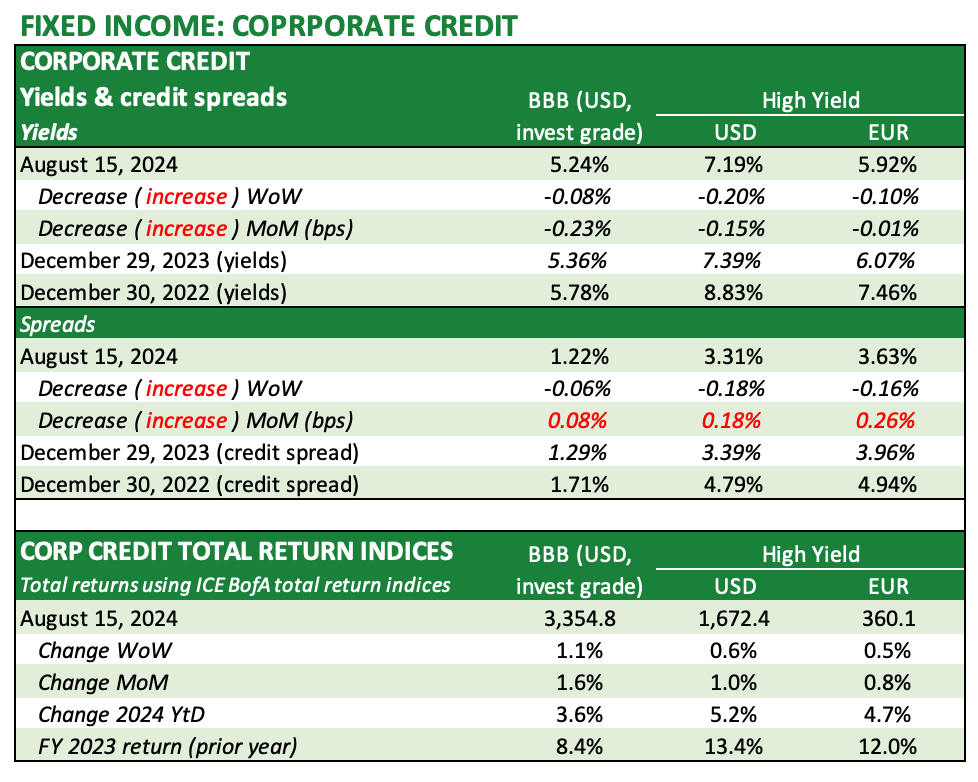

Corporate credit spreads were tighter across investment grade and non-investment grade credit spectrum last week, with yields also falling across the credit curve. Total returns are positive and relatively good in both investment grade and high yield YtD, although not keeping pace with the attractive 2023 FY returns. A “Goldilocks economy” and a series of Fed rate cuts should boost high yield returns the rest of the year, should another “recession scare” be avoided.

The Yen weakened although in an orderly fashion last week, and the Dollar also weakened, with the beneficiaries being stronger Sterling and Euro. The price of gold continues to increase broaching $2,500/oz intraday last week, slightly odd to me in that inflation is coming down and risk is clearly back on. Oil prices fell as concerns over an imminent Iran + proxies strike on Israel subsided for the time being. Bitcoin was weaker last week but continues to show impressive gains YtD of nearly 40%.

WHAT’S AHEAD

Economic data this coming week includes July CPI for the Eurozone, and preliminary PMI data for August for both Europe and the US.

Jackson Hole symposium (August 24-26), in which Fed Chairman Powell will speak on August 25th

AI/NVDA earnings: After all the AI concerns, certainly NVDA’s earnings release slated for August 28th will be a focal point for investors and influential for tech shares (especially the semi-conductor value chain)

Monetary policy meetings perhaps most in focus the BoJ and the FOMC:

FOMC: Sept 17/18, Nov 6/7 and Dec 17/18

Bank of Japan: Sept 19/20, Oct 30/31 and Dec 18/19

ECB: Sept 12, Oct 17 and Dec 12

Bank of England: Sept 19, Nov 7 and Dec 19

MY TRADES LAST WEEK

The only trade I put on last week was a hedge around my entire SBUX position after the shares jumped nearly 25% following the announcement of new CEO Brian Niccol, the former CEO of Chipotle (CMG), on Tuesday. I bought $85 puts (mid-Sept) funded by covered calls at $100 (expired yesterday) and $105 (mid-Sept). The stock closed the week at $94.81/sh.

_________________

**** Follow E-MorningCoffee on Twitter, and please like and comment on my posts right here on my blog. You need to be a subscriber, so please sign up. Thanks for your support. ****

Comments